A new year has arrived and with it comes the opportunity for a financial reset with the 100 Envelope Challenge.

While many people focus on a physical reset at the start of a new year, others look toward money savings goals. Just like a workout program or diet, financial goals take some serious discipline and “want to.”

According to financial expert Dave Ramsey, the best way to live is debt-free, and the only way to accomplish that is to live on less than what you make and to save for emergencies and unexpected expenses.

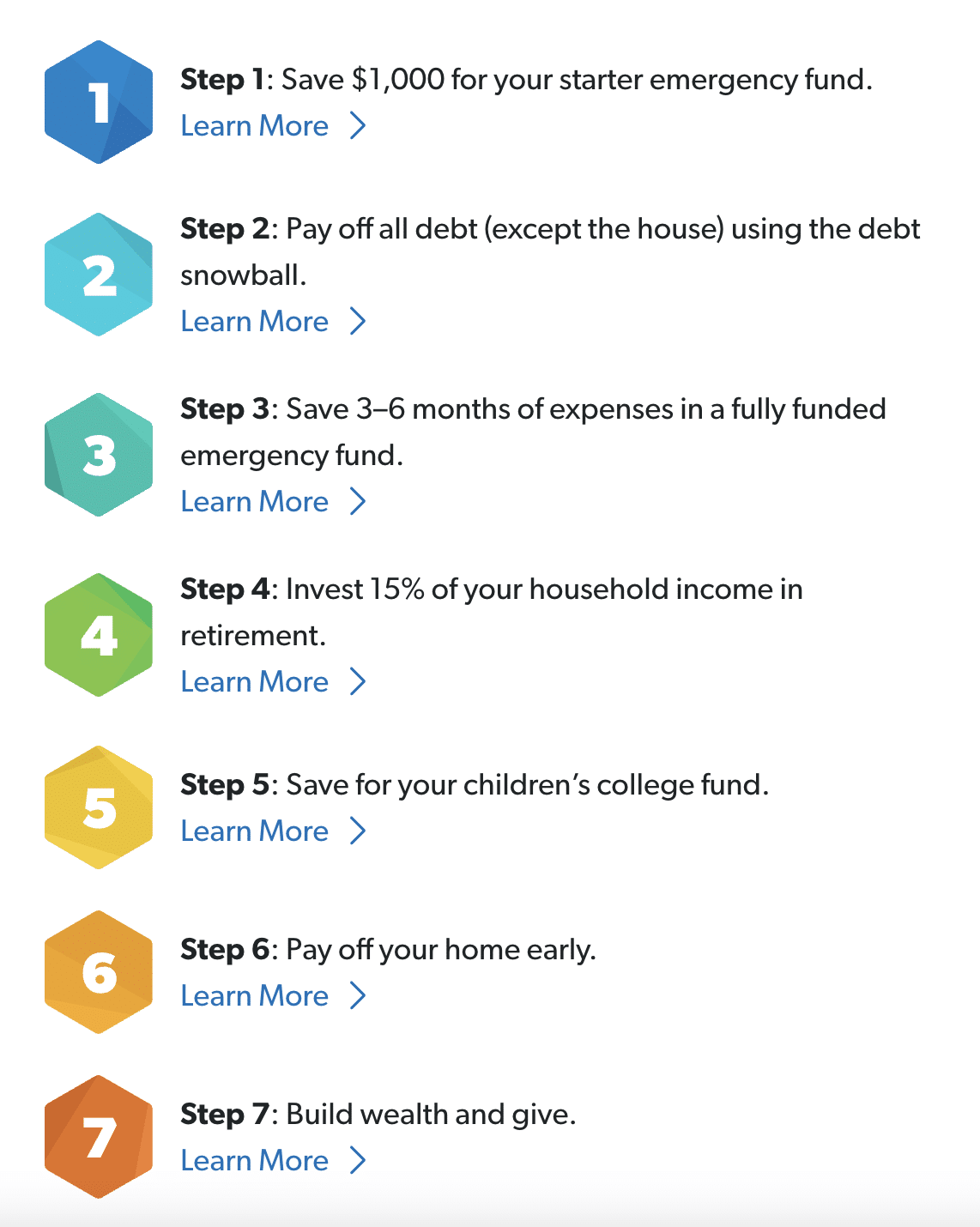

Ramey is best known for his Baby Step approach to financial freedom.

Those steps are:

Some of these steps seem daunting, depending on your financial status and debt load. But, a great first step to a financial reset is to exercise your savings muscle. Learning how to save money by cutting back on spending and getting rid of unnecessary expenses.

How To Cut Spending And Reduce Unnecessary Expenses

Use Coupons

Many of us remember the days when our mothers would clip coupons from the Sunday paper to trim the grocery bill. The same deals are available today, but mostly in digital form. Sites like The Krazy Coupon Lady and RetailMeNot are a good place to look for coupons and discount codes.

Eliminate Subscriptions

The average person has 4.5 streaming subscriptions and pays nearly $1000 a year for them. Most people only use one or two of those services on a regular basis. If delivery service, meal services, cloud-based apps, and other subscriptions were included, chances are that you aren’t getting out of them what you’re paying.

Change Your Cellular Provider

The average cell phone bill in 2024 was $141 a month or nearly $1700 a year! Family plans and contract-free plans like Visible and Mint Mobile are great ways to cut cell service costs. Visible and Mint offer unlimited talk, text, and data for roughly $30 a month, for an average savings of more than $1300 a year.

Re-evaluating your insurance coverage, planning for meals, and sticking to a detailed budget are also helpful ways to cut costs.

How To Save $5000 By Tax Day

If your goal is to bulk up your savings account, the team at Ramsey Solutions shared a 100 Envelope Challenge that will allow you to save $5K by Tax Day (April 15).

Here’s how it works: For 100 days, you put a certain amount of cash in 100 envelopes. By the end of the challenge, you will have saved $5050.

To get started, label 100 envelopes from 1 to 100. Each day randomly pick an envelope and put the amount of cash written on it inside. To be successful you will need to monitor your spending and might even need to hustle to round up the money needed for that day’s envelope.

Nobody said this challenge would be easy. In fact, some days may be a real struggle. But, this is where it can get fun. If you don’t have the money needed to add to an envelope, find something to sell! The saying “One man’s trash is another man’s treasure” has never been more true. In this case, your trash could become YOUR treasure if it helps you reach your goal.

Read more about the 100 Envelope Challenge here, and let us know if you give it a try. Remember – “A penny saved is a penny earned.” If you find that your financial situation doesn’t allow you to save the full amount, any money saved over the next 100 days is more than you had saved before!

Save $5K Without A Deadline

Another alternative to the Envelope Challenge is to do it without a time limit. Number your envelopes as stated above and contribute to them as you have extra cash until they are filled. You can purchase plain white envelopes and number them yourselves, or you can use a fancy money-saving binder to help track your savings goal like the one found HERE.

What To Do With The Money You Saved

At the end of the challenge, it’s time to decide what to do with all of the money you saved. If you have debt, it’s a great time to jump into Dave Ramsey’s Baby Steps! Put $1000 back for emergencies and put the rest toward paying off debt.

If you’re already debt-free, you may decide to share some of the money you squirreled away. Find a charity or someone in need to bless. Another option is to book a well-deserved getaway or do some overdue home maintenance.

Regardless of how you choose to use your 100 Envelope Challenge Savings, do it joyfully, knowing that you crushed a huge goal and are better off for it!